Somnia: Token Generation Event | Messari

Key Insights The SOMI token went live on day 1 of Somnia’s mainnet, with 16.02% of the total token supply circulating at TGE. Somnia will follow a phased governance plan to reduce the foundation’s control and allow token holders to vote, propose, and approve expenditures. SOMI will have a fixed supply of 1 billion tokens,…

Key Insights

- The SOMI token went live on day 1 of Somnia’s mainnet, with 16.02% of the total token supply circulating at TGE.

- Somnia will follow a phased governance plan to reduce the foundation’s control and allow token holders to vote, propose, and approve expenditures.

- SOMI will have a fixed supply of 1 billion tokens, with 10% allocated to secure the network via validator rewards.

- 50% of every transaction fee is burned, linking the SOMI supply to onchain usage. The other half is paid to validators.

Primer

Somnia (SOMI) is an EVM-compatible Layer-1 blockchain designed to bring complex, real-time applications fully onchain. At its core, Somnia combines a parallelized MultiStream consensus engine with compiled EVM bytecode execution and IceDB, a low-latency data store. The design targets sub-second finality, sub-cent fees, and reactive onchain primitives that let apps respond to state changes in real time.

The network emphasizes seamless interoperability and asset portability across Somnia so developers can reuse users, liquidity, and state across ecosystems while keeping application logic onchain. Somnia launched its mainnet and SOMI token on September 2, 2025.

Website / X / Discord / Telegram

Tokenomics

On August 15, Somnia revealed SOMI, the native token of the Somnia blockchain, with a maximum supply of 1 billion tokens. Unlike other blockchains, which pay out inflationary token emissions to validators securing the network, Somnia allocates a fixed 10%, allowing Somnia to cap the overall supply. Somnia’s token generation event occurred on the same day as its mainnet launch.

Allocations

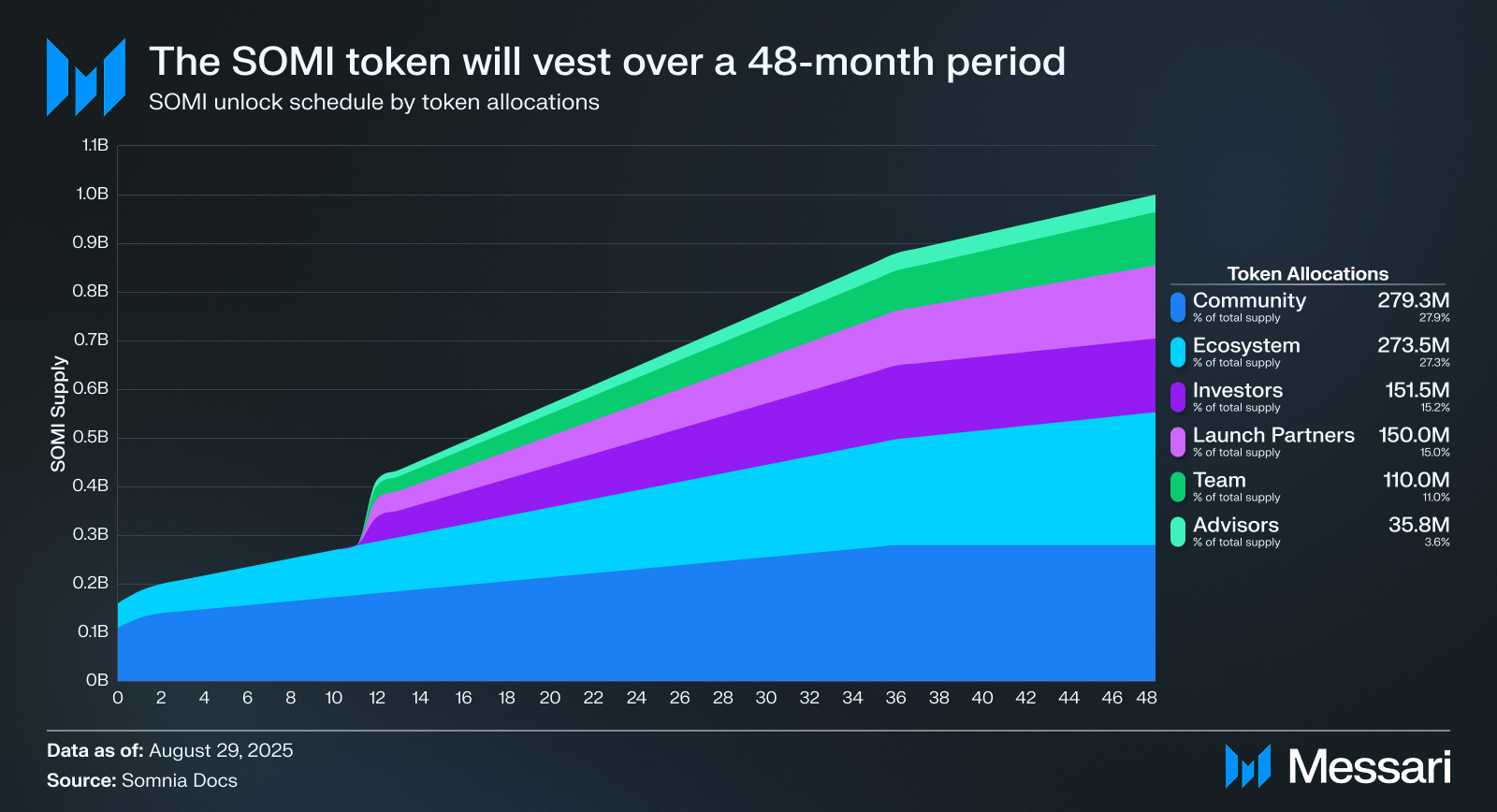

- Community (27.93%): 279.3 million tokens for contributors, validator rewards, and liquidity.

- Ecosystem (27.35%): 273.5 million tokens to fund ecosystem development and the foundation, including grants and strategic initiatives.

- Investors (15.15%): 151.5 million tokens allocated to seed investors.

- Launch Partners (15.00%): 150.0 million tokens for early contributors to the Somnia ecosystem.

- Team (11.00%): 110.0 million tokens for founders and early team members.

- Advisors (3.58%): 35.8 million tokens to key advisors providing strategic and technical guidance.

Unlocks

Somnia’s token supply will vest over 48 months. At TGE, 16.02% of the SOMI supply enters circulation: 10.945% from the Community allocation and 5.075% from the Ecosystem allocation. The Community allocation will have additional unlocks in the first 2 months post-TGE, followed by 36 months of linear vesting. Ecosystem vests linearly over 48 months from launch. The Investor and Advisor allocations are subject to a 12-month cliff, followed by linear vesting over 36 months. The Somnia Team and Launch Partners allocations vest over 48 months, preceded by a 12-month cliff period.

Fee Burn Mechanics

Somnia implements a deflationary mechanism by permanently burning 50% of all transaction fees. This means that for every SOMI used to pay for gas, 0.50 SOMI is removed from the total supply during settlement, making SOMI structurally deflationary. The other 0.50 SOMI is distributed to validators based on stake weight. All transactions on the network are subject to this burn mechanism.

SOMI Token Utility

Staking

SOMI secures the network via staking. To join the active validator set, validators must hold 5.0 million SOMI per node and meet minimum hardware requirements. Self-staked validators retain 100% of the rewards their node earns.

Validators can also source stake from token holders through two delegation paths: (1) a validator-specific pool, where token holders lock stake with a 28-day unbonding period and may “emergency unstake” at a 50% principal penalty that is sent to the treasury; and (2) a general validator pool, which spreads stake across all validators offering delegation, applies no lock, and prioritizes understaked validators.

Validators set a share rate that determines what portion of their rewards flows to delegated stakers. If a validator falls below its minimum, it has a cooldown period (about one month) to restore stake.

Gas Fees

All transaction fees on the Somnia blockchain must be paid in SOMI.

Governance

SOMI is expected to carry governance rights as the network decentralizes. Governance is organized across five groups with distinct mandates.

- The Token House (token holders) proposes and votes on the use of foundation and community tokens.

- A Validator Council oversees protocol upgrades, gas economics, and hard forks.

- A Developer Council steers the technical roadmap.

- A User Assembly provides a check on other bodies.

- A Foundation Board initially controls the treasury and code deployments, with emergency-override powers.

Authority is expected to shift in phases. During the bootstrap phase (0–6 months post-mainnet), the Foundation Board retains control while other groups are formed. In the transition phase (6–24 months), token holders will begin submitting proposals and voting, though the Foundation Board remains the final arbiter.

In the mature phase (24+ months), decision-making is delegated to the relevant groups; Token House approvals guide fund allocations, subject to possible veto by the User Assembly or the Foundation Board in exceptional cases. Specific thresholds and procedures may evolve over time.

Closing Summary

Somnia is an EVM-compatible L1 built to run complex, real-time applications onchain. Its parallel MultiStream consensus and IceDB data store target sub-second finality and low fees. SOMI has a hard cap of 1 billion, validator emissions are fixed at 10%, and 50% of every transaction fee is burned, linking supply to usage.

Token utility centers on staking to secure the network, paying gas in SOMI, and governance as authority shifts from the foundation toward token holders and councils. SOMI tokens will vest over 48 months, with early liquidity concentrated in community and ecosystem allocations.

The TGE is a stepping stone towards realizing a permissionless ecosystem for creators and users to steer the protocol through its phased roadmap. Somnia’s ability to attract applications and reduce foundation-led control of the network will be instrumental in realizing its vision of being a substrate for complex onchain applications.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Somnia Network. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.