Crypto Whales Buy $30M of Tokenized Gold Amid New All-Time Highs

Key Notes Two major whales accumulated $30M in Tether’s gold-backed tokens as the precious metal surged past $4,200 per ounce. Gold’s market cap of $29.27 trillion dwarfs all other assets, including Nvidia’s $4.5 trillion and Bitcoin’s $2.21 trillion valuations. The shift to tokenized gold follows a historic crypto crash that wiped out $19 billion in…

Key Notes

- Two major whales accumulated $30M in Tether’s gold-backed tokens as the precious metal surged past $4,200 per ounce.

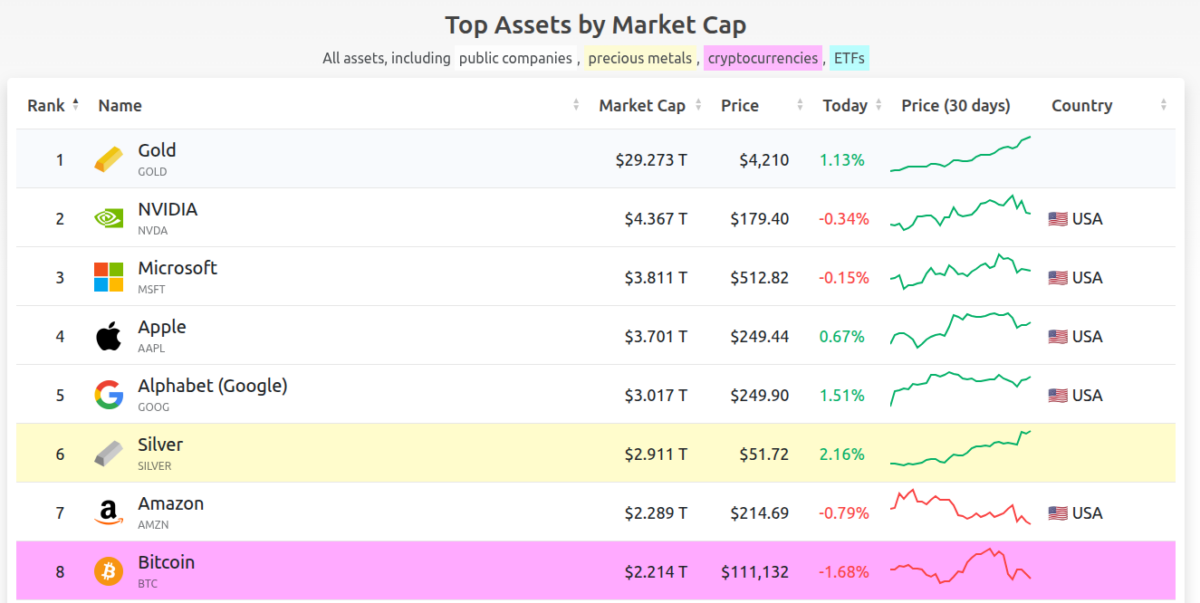

- Gold’s market cap of $29.27 trillion dwarfs all other assets, including Nvidia’s $4.5 trillion and Bitcoin’s $2.21 trillion valuations.

- The shift to tokenized gold follows a historic crypto crash that wiped out $19 billion in liquidations across digital asset markets.

Gold has made a new all-time high on October 15, following previously achieved, subsequent record highs this week on October 13 and 14. As the leading commodity rallies, some crypto whales were seen stacking millions of dollars worth of XAUt, Tether’s tokenized gold.

In particular, Lookonchain spotted two whales who, together, bought more than $30 million worth of XAUt over the past week. The most recent purchase happened on this date, with Whale 0xdfcA acquiring 2,879 XAUt, valued at $12.1 million by the posting time.

Before that, casualpig.eth bought 4,463 of the tokenized gold, worth $18.7 million according to Lookonchain.

Whales are buying $XAUT(Tether Gold)!

casualpig.eth bought 4,463 $XAUT($18.7M) over the past week.

Whale 0xdfcA bought 2,879 $XAUT($12.1M) today. pic.twitter.com/jejcyVUrOk

— Lookonchain (@lookonchain) October 15, 2025

XAUt is the second-largest gold-pegged stablecoin by market capitalization, with a $1 billion market cap at the time of this writing, losing only to PAX Gold

PAXG

$4 219

24h volatility:

1.3%

Market cap:

$1.31 B

Vol. 24h:

$390.68 M

, with a market value of $1.30 billion. These tokens allow traders and investors to get self-custody, permissionless, and portable exposure to gold without having to store actual gold bars or buy centralized contracts on TradFi.

Gold Makes 3 New All-Time Highs in 3 Days

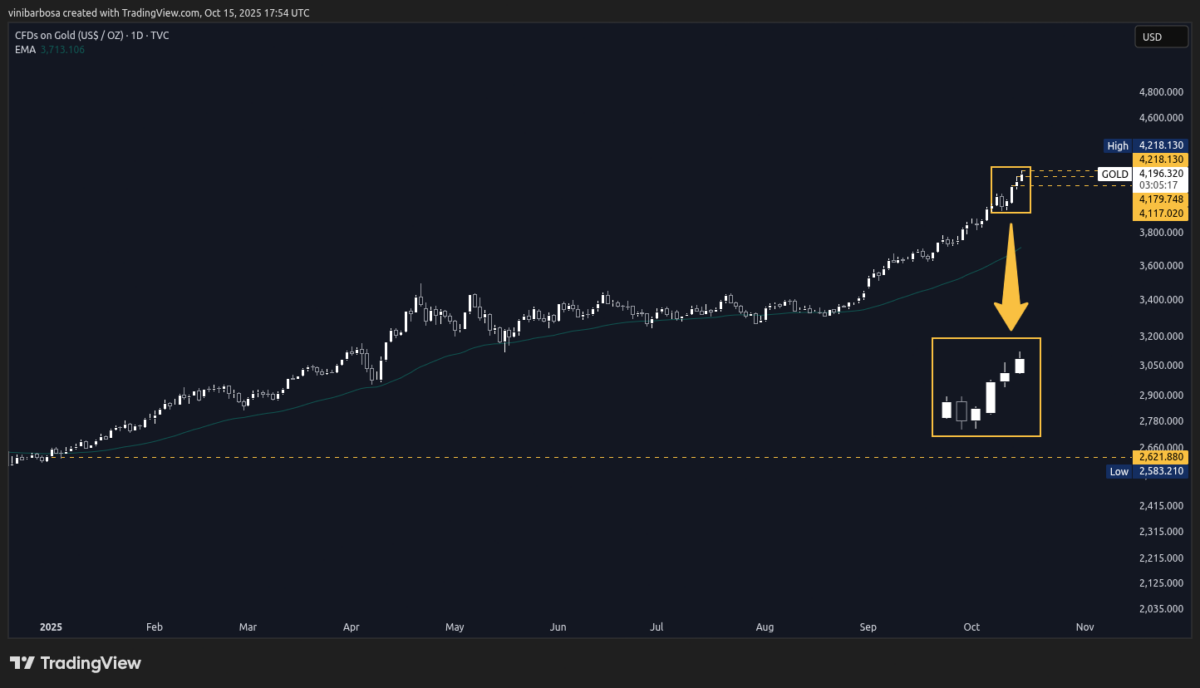

CFDs on gold are currently trading at $4,196 per ounce, according to TradingView’s index. Earlier on October 15, the contracts reached a new all-time high at $4,218, following two previous, subsequent record highs of $4,117 and $4,179 on October 13 and 14, respectively.

Seven days ago, the precious metal made a record high past the $4,000 psychological resistance on October 8. Gold consolidated on this level on October 9, just to retrace before the week closed on October 11.

CFDs on Gold (US$ / OZ) as of October 15, 2025 | Source: TradingView

Gold is the leading commodity and the world’s most valuable asset, with a $29.27 trillion market capitalization. For a comparison, Nvidia has the world’s second-largest market cap, currently below $4.5 trillion. Silver is the second-largest commodity, with less than $3 trillion, based on data from CompaniesMarketCap.

Top assets by market cap, as of October 15, 2025 | Source: CompaniesMarketCap

Bitcoin

BTC

$111 222

24h volatility:

1.6%

Market cap:

$2.21 T

Vol. 24h:

$72.10 B

, the leading cryptocurrency, has a $2.21 trillion market cap, trading at $111,132, as cryptocurrencies recently experienced an unprecedented crash with more than $19 billion in liquidations. This historical event could have made investors rotate part of their capital to gold, getting exposure via tokenized solutions like the one offered by Tether.

next

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Vini Barbosa on X