BlackRock’s IBIT Bucks the Trend with Continued Inflows Despite Weak BTC Price Action

U.S. spot bitcoin exchange-traded funds (ETFs) recorded their largest combined daily outflow since Sept. 26 on Monday, with $326.4 million exiting the market, according to Farside data. However, BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot bitcoin ETF by assets on the market, bucked the broader trend by continuing to see inflows. Over the past…

U.S. spot bitcoin exchange-traded funds (ETFs) recorded their largest combined daily outflow since Sept. 26 on Monday, with $326.4 million exiting the market, according to Farside data.

However, BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot bitcoin ETF by assets on the market, bucked the broader trend by continuing to see inflows.

Over the past two trading sessions, IBIT has recorded $134 million in new inflows, even as bitcoin’s price fell from $122,000 to $107,000.

The fund has now logged 10 consecutive trading days of inflows. However, net inflows over the past two trading days were significantly smaller compared with the previous eight sessions, each of which saw at least $200 million in inflows. In contrast, the most recent sessions saw inflows drop sharply to $74.2 million and $60.4 million, respectively, according to Farside data.

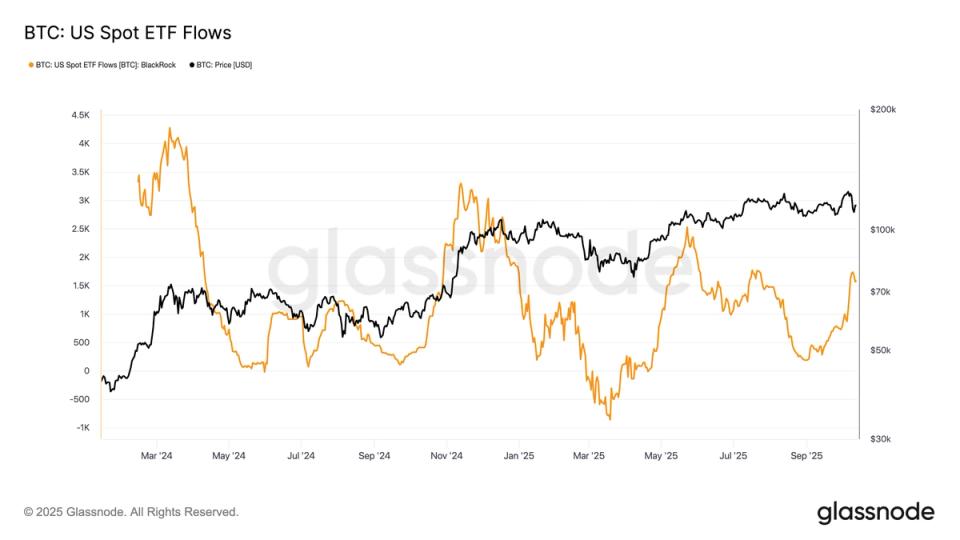

Glassnode data shows that IBIT’s flows have closely mirrored bitcoin’s price action historically, with inflows rising during rallies and outflows following price declines. Since bitcoin reached an all-time high of $126,000 on Oct. 6 which was subsequently followed by a correction of roughly 20%, IBIT has seen consistent inflows, even as many other ETF issuers have experienced redemptions or no flows at all.

U.S. Market Returns Getting Weaker

Data from Velo shows that bitcoin’s performance during U.S. trading hours has weakened considerably, since bitcoin’s all-time high.

In the first few days of October, the asset was up more than 10% during U.S. hours over the past month but that figure has since dropped to 1.7%.

Despite this decline, bitcoin continues to outperform during U.S. hours compared with trading sessions in Europe and Asia which are both in negative returns over the past month.